MyFatoorah

Streamline payments across the Middle East and South Asia with MyFatoorah’s multi-channel gateway—fully integrated with your Webenoid SaaS platform.

Key Features

Supports major GCC and South Asian currencies

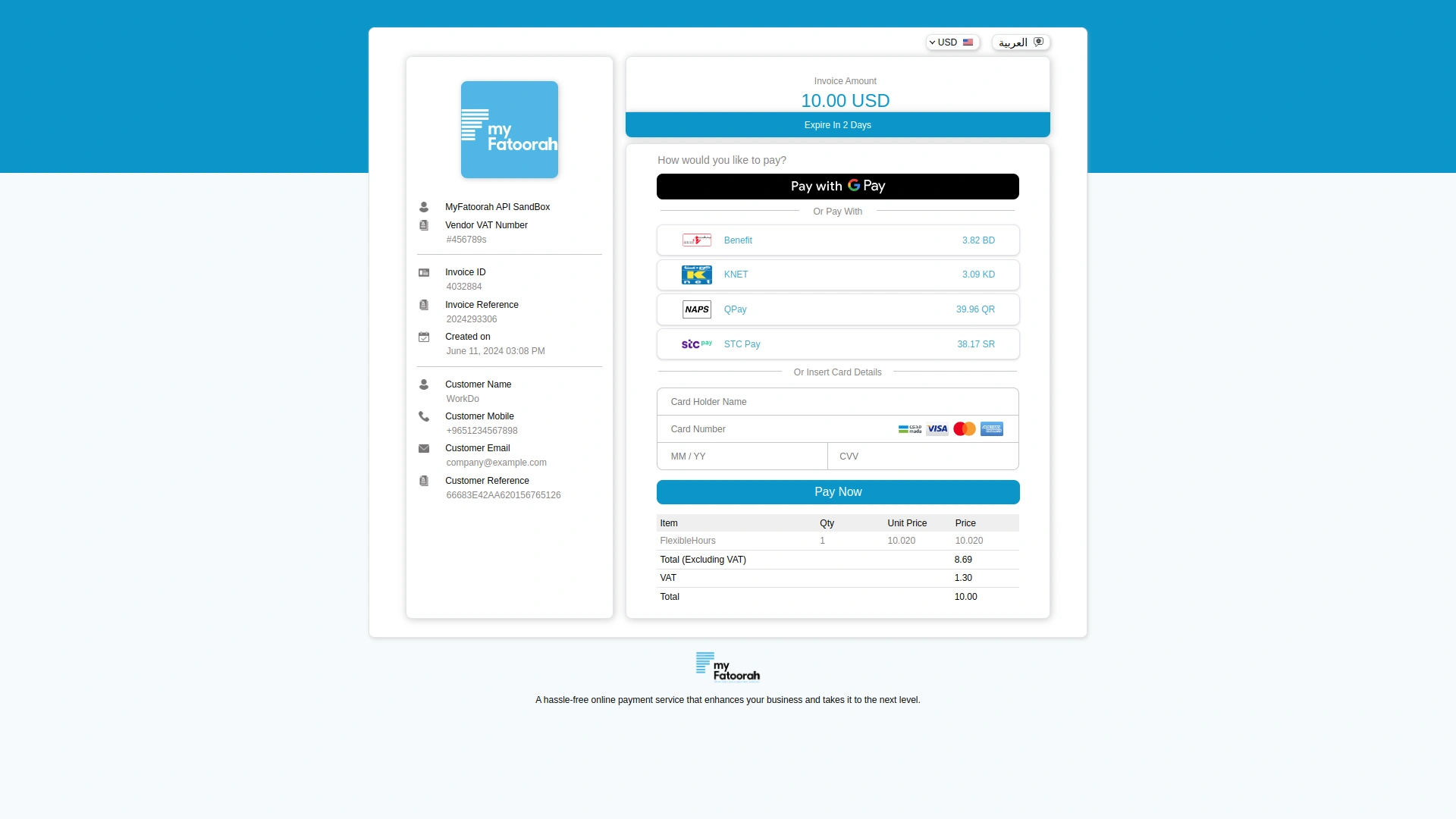

Accept payments via KNET, Apple Pay, Google Pay, STC Pay, and more

Instant transaction confirmations and detailed logs

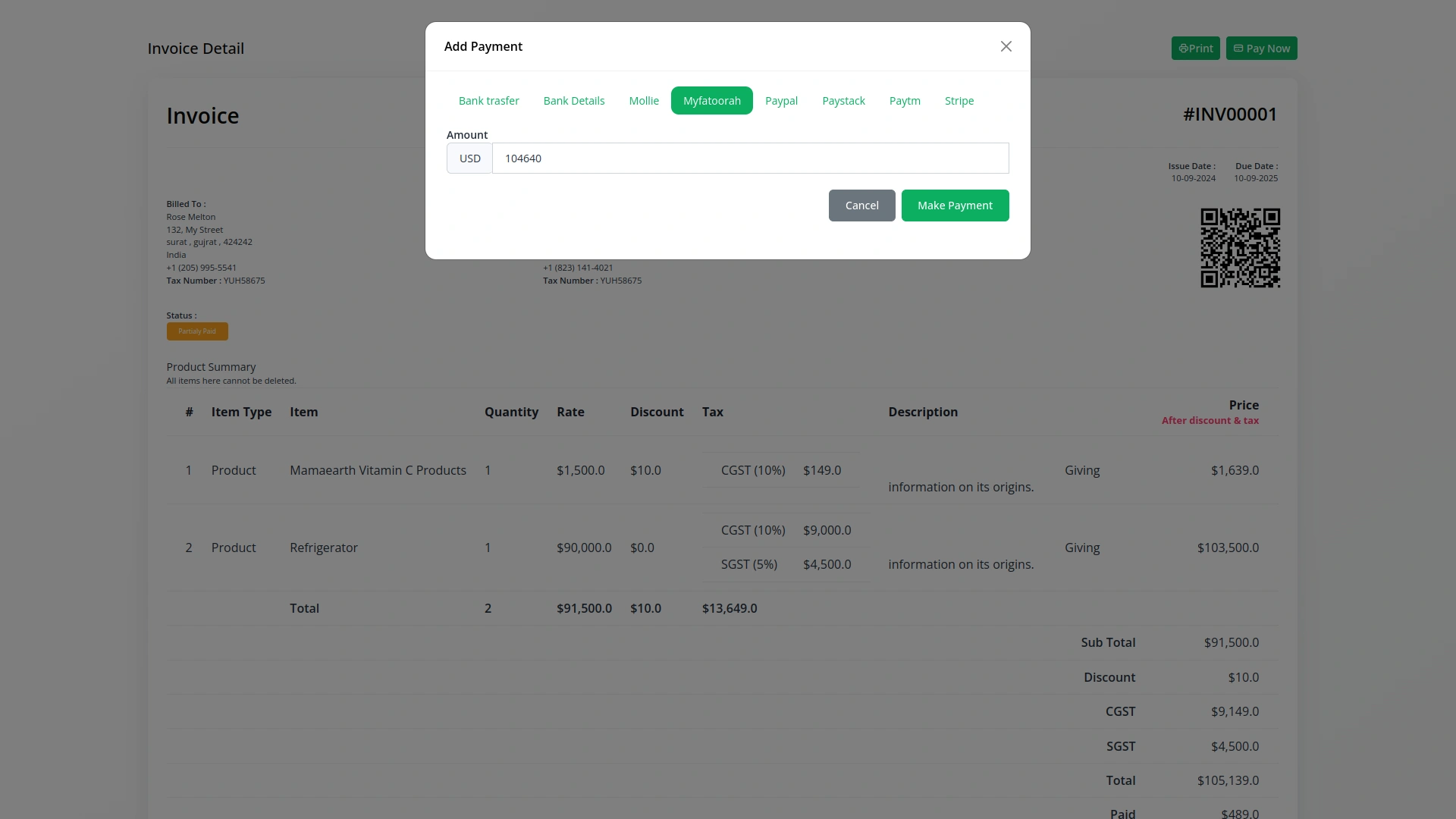

Dedicated setup for recurring plans and invoice payments

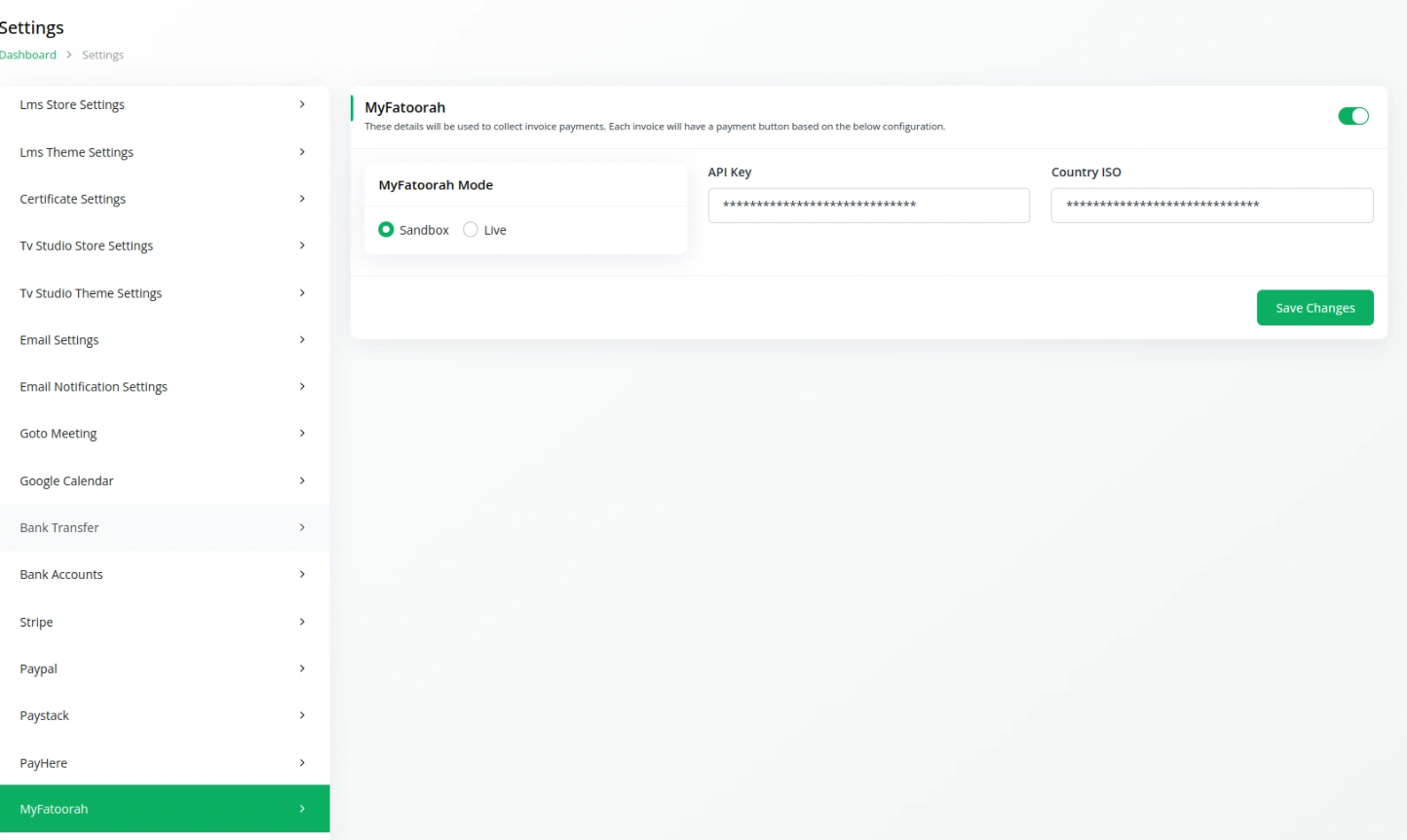

Easy API key configuration for both Superadmin and Company accounts

Built for Gulf & South Asian Markets

MyFatoorah bridges the payment gap across Kuwait, Saudi Arabia, the UAE, and India by offering culturally aligned, localized checkout options. Accept regional wallets and cards with minimal setup and maximum security.

Flexible Transaction Handling

Whether you’re charging for subscriptions, sending advance payment requests, or issuing post-service invoices—MyFatoorah makes the entire payment lifecycle effortless and trackable from your Dash SaaS dashboard.

Centralized Integration Setup

Configure your API keys once and connect both Superadmin and Company-level accounts to the gateway. The shared configuration panel ensures a consistent and friction-free integration experience across your organization.

Full Description

Powering Regional Payments with MyFatoorah

MyFatoorah is a trusted payment solution across the GCC and parts of South Asia, making it an ideal fit for businesses operating in these regions. This Webenoid SaaS integration enables you to accept online payments in multiple currencies through a wide range of popular channels—KNET, STC Pay, Apple Pay, QPay, and more.

The module supports recurring billing and one-time invoices, providing versatility for different monetization models. With real-time status updates, advanced fraud protection, and mobile-first compatibility, your customers enjoy smooth transactions while you gain complete financial control.

Leverage MyFatoorah’s deep regional support and intuitive setup to enhance your platform’s checkout experience, reduce manual effort, and unlock seamless financial operations in new and familiar markets.