Double Entry

Maintain financial integrity with automated debit and credit entries using the Double Entry accounting method. Ensure compliance, improve reporting accuracy, and streamline your bookkeeping.

Key Features

Journal entries with automated debit and credit classification

Complete double-entry financial system for accuracy and compliance

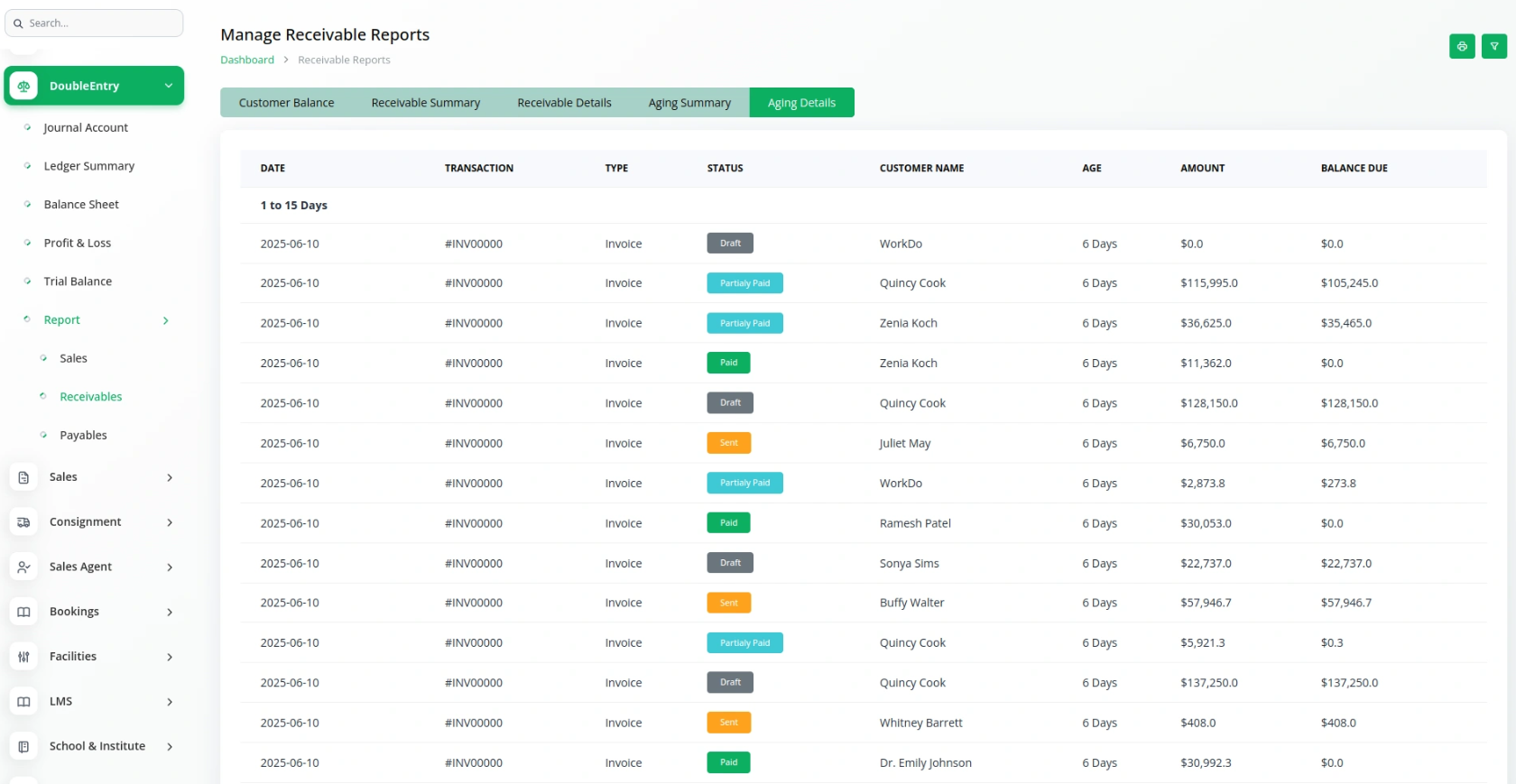

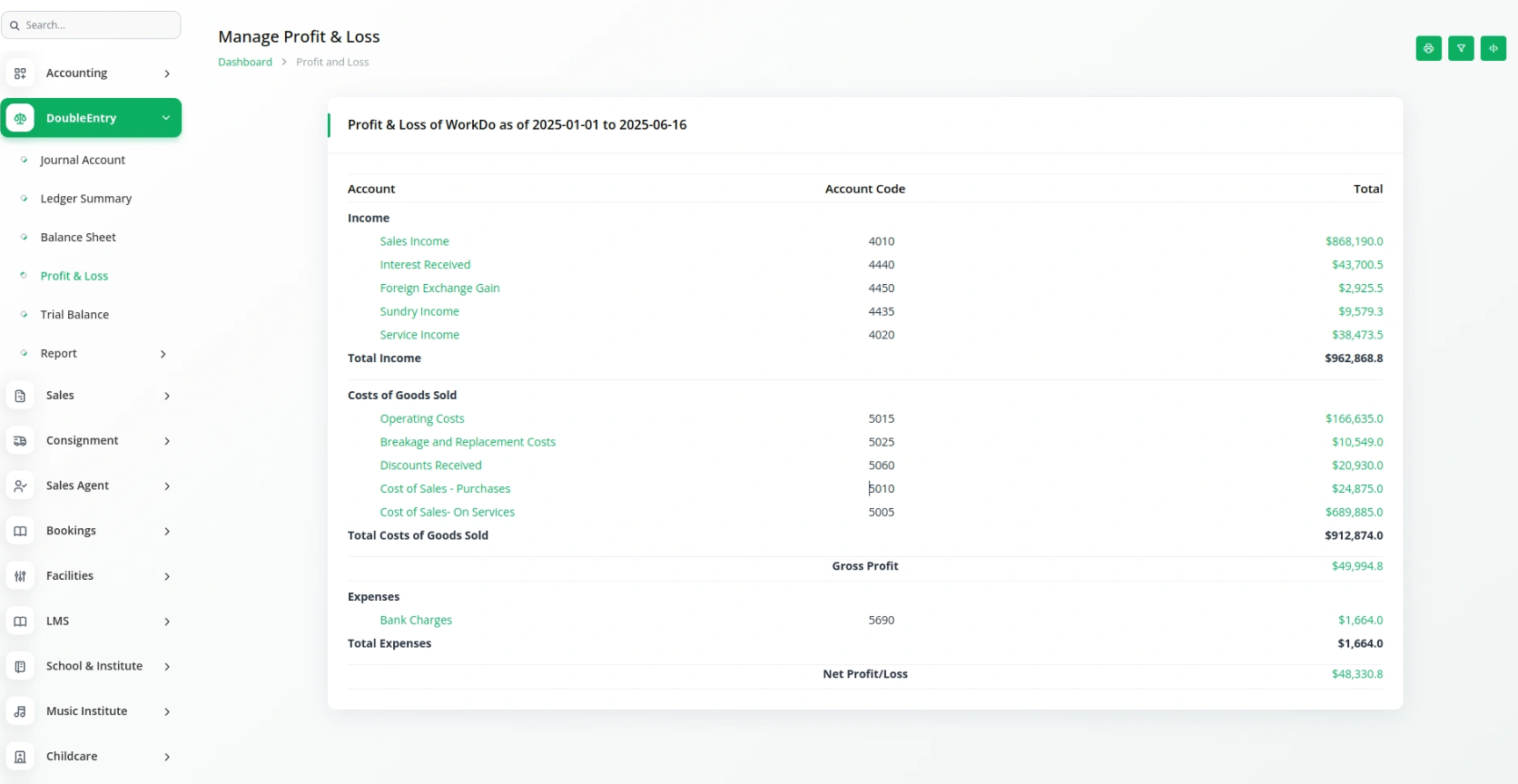

Real-time balance sheet, trial balance, and profit & loss reports

Unified ledger tracking all financial activity

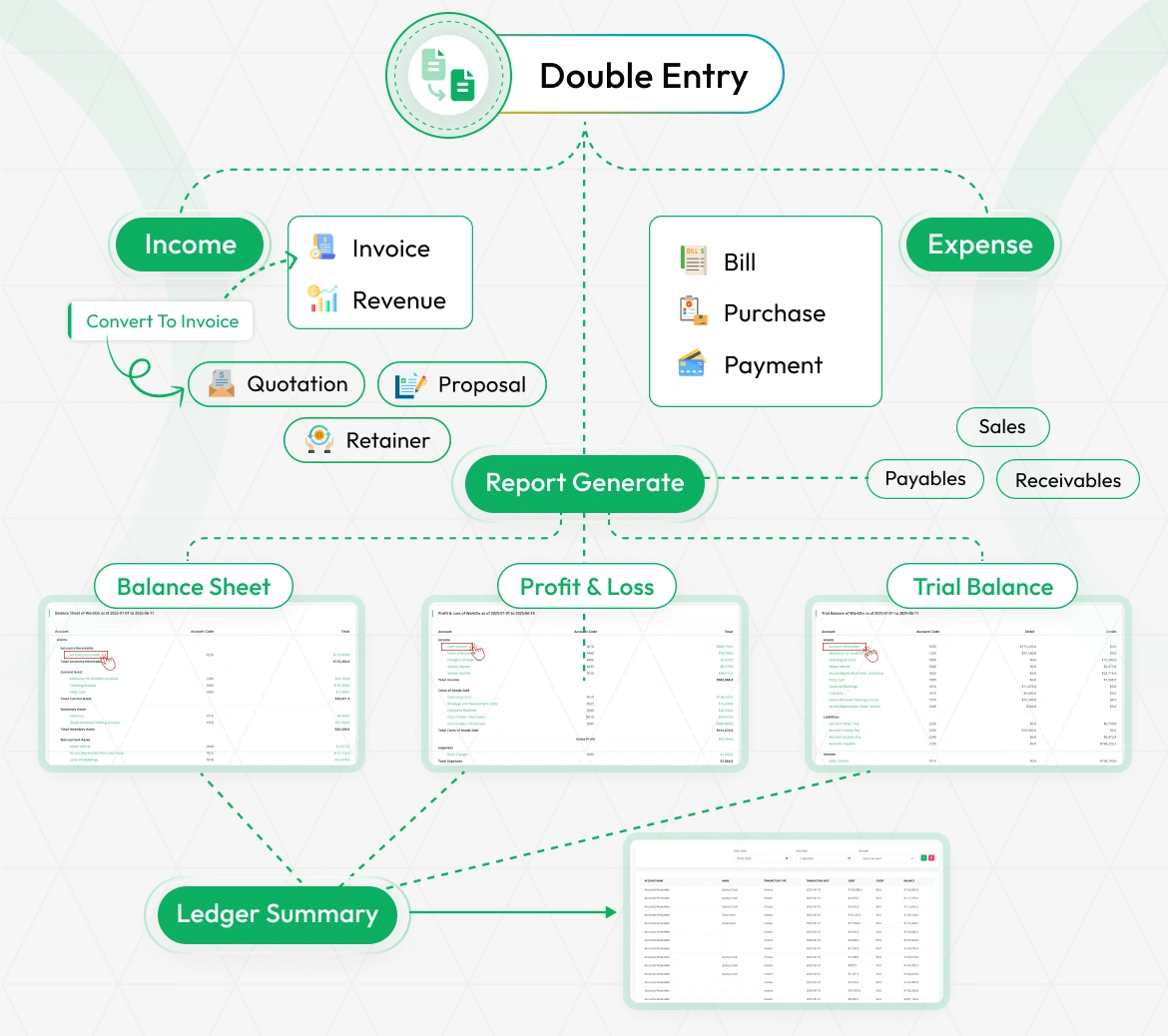

Auto-journaling from quotes, retainers, and invoices

Accurate Journal Entry Management

Manually or automatically create journal entries that adhere to the double entry method. Every transaction is reflected in both debit and credit formats, eliminating discrepancies and providing a complete audit trail.

Unified Financial Reporting

Get a comprehensive view of your financial health with real-time access to a trial balance, profit & loss statements, and the full ledger. All reports are automatically updated based on journal activity, ensuring integrity.

Auto-Generated Entries from Invoices & More

When quotations, proposals, or retainers are converted to invoices, the system auto-generates the corresponding double-entry records. This automation streamlines bookkeeping and maintains consistency across modules.

Full Description

Streamline Financial Integrity with Double Entry Accounting

The Double Entry Add-On brings industry-standard accounting to your Webenoid SaaS system. Every transaction impacts two accounts—ensuring that your books stay balanced and compliant with modern financial regulations. Whether you’re managing client invoices, vendor bills, or journal adjustments, the system creates a matching debit and credit entry to preserve financial consistency.

With features like journal entry management, a unified ledger, balance sheets, trial balance, and automated entries from invoices, this module becomes a central piece of your financial operations. It’s ideal for businesses looking to improve accuracy, pass audits smoothly, and maintain total clarity in their accounting processes.