Instamojo

Enable fast, secure, and localized payments with Instamojo – the ideal gateway for SaaS businesses serving Indian customers.

Key Features

Tailored for Indian businesses and INR payments

Supports UPI, Net Banking, Credit/Debit Cards, and Wallets

No complicated coding—easy integration with Webenoid

Robust fraud protection and transaction tracking

Ideal for subscriptions, one-time fees, and in-app billing

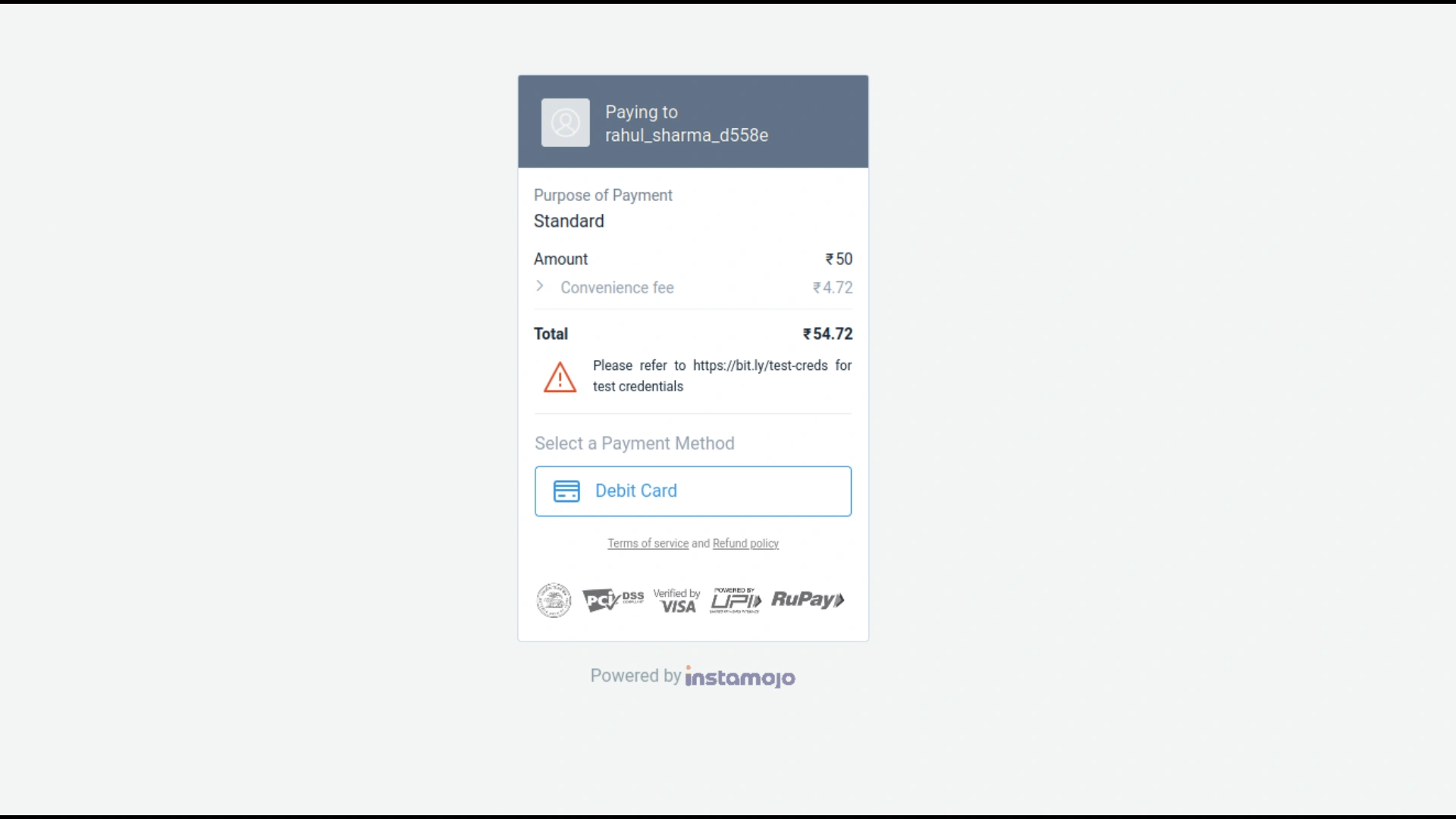

Made for India’s Digital Payment Ecosystem

Instamojo is built to match the payment habits of Indian consumers. Whether it’s UPI, digital wallets, or net banking, your customers will feel right at home with the checkout experience.

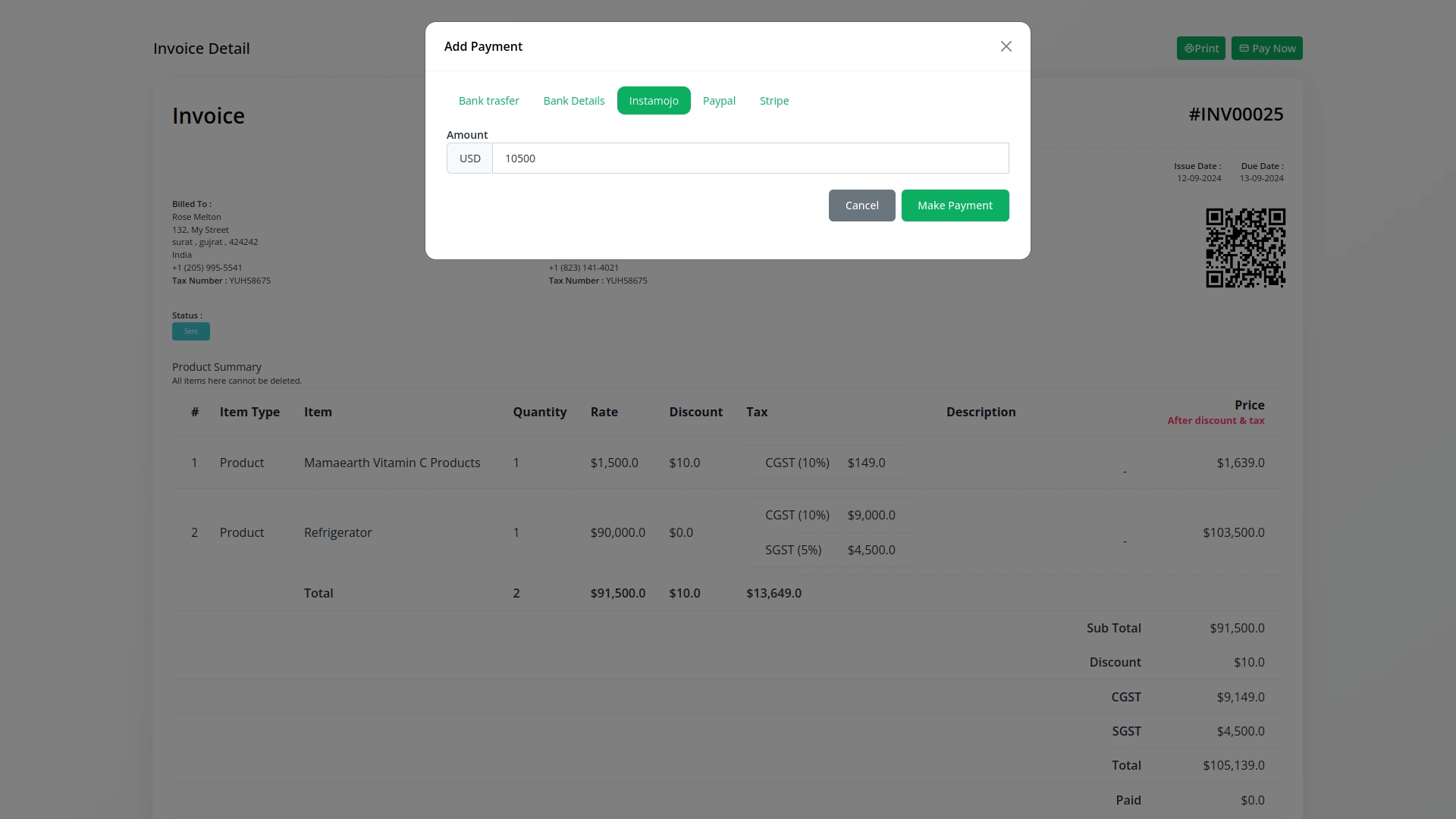

Effortless SaaS Billing

Simplify how you collect revenue. From plan subscriptions to individual add-on purchases, Instamojo integrates with your billing workflows to ensure secure, timely payments.

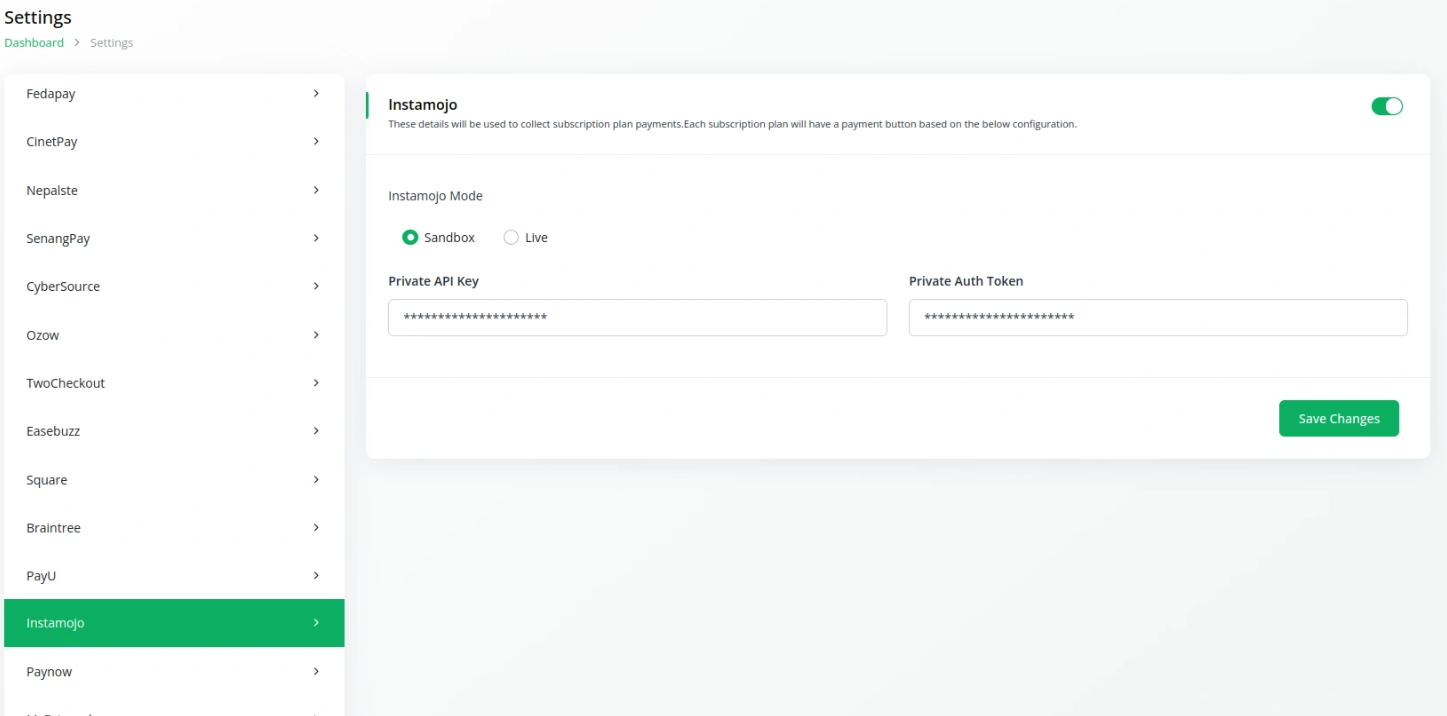

Smooth API Key Setup

Get connected in minutes using our API key setup panel. Whether you are a Superadmin managing global plans or a Company admin handling local invoices, the shared integration makes onboarding easy and consistent.

Full Description

Designed for Indian SaaS Businesses

Instamojo brings simplicity, security, and flexibility to online payments within India. This integration is perfect for SaaS companies focused on Indian customers who demand local payment options like UPI, RuPay, wallets, and net banking.

Whether you’re running subscription plans, selling one-time products, or handling custom invoices, Instamojo handles the transaction flow with ease and compliance. Customers experience a familiar and intuitive checkout, while you benefit from streamlined reconciliations and analytics.

Setup is easy thanks to Webenoid Webenoid SaaS’s unified gateway integration panel. Once you enter your API keys, both Superadmin and Company accounts can begin accepting payments without any additional setup overhead. From startups to scale-ups, this is the payment partner your SaaS platform needs in India.