Flutterwave

Accept online payments across Africa and beyond with Flutterwave’s secure, multi-currency platform designed for scalable cross-border transactions.

Key Features

Supports multiple African currencies along with USD, GBP, and EUR

Easy API key configuration for secure payment setup

Cross-border transaction capability with real-time payment confirmation

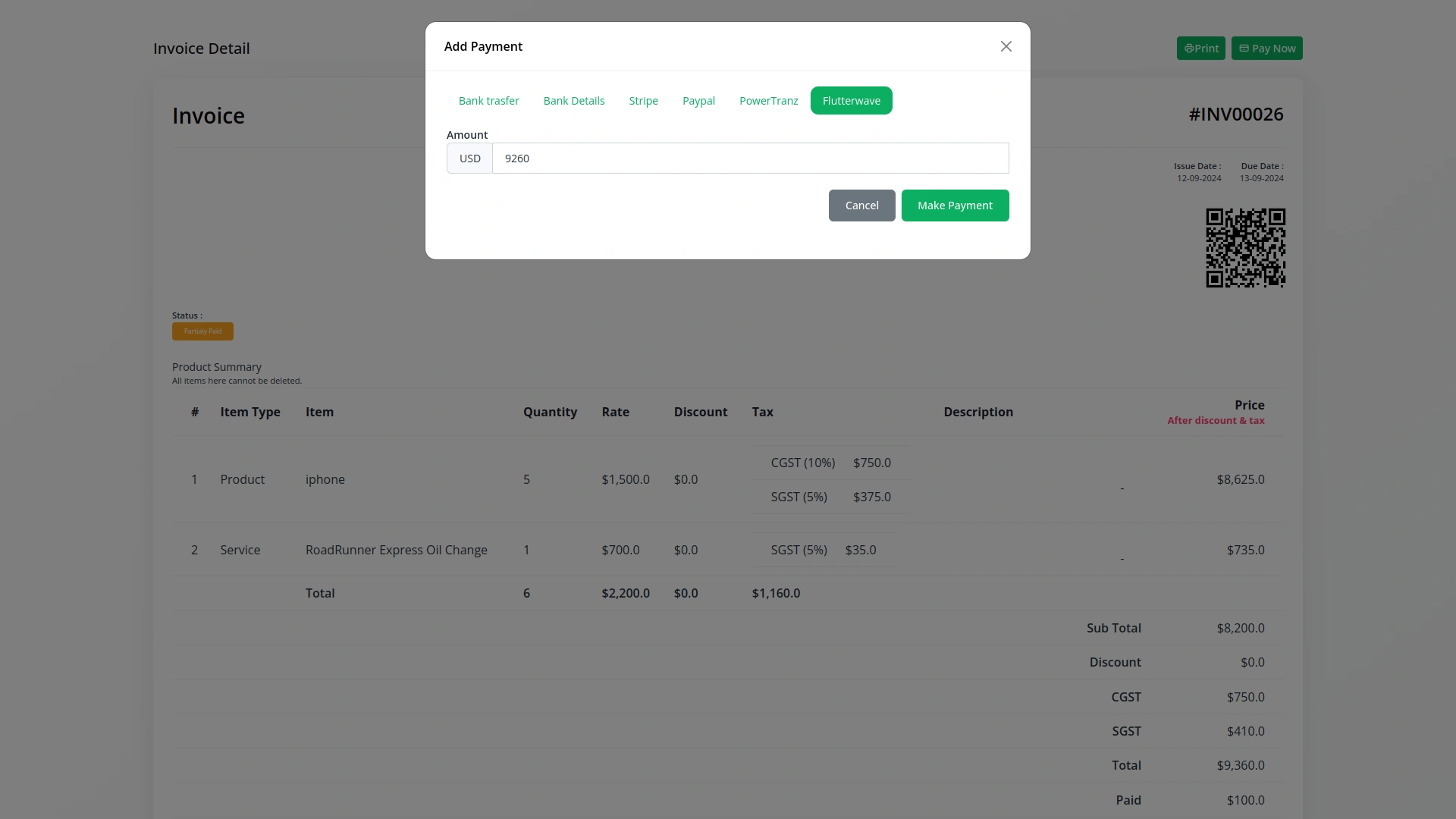

Electronic invoicing for both retainers and one-time sales

Compatible with plan payments and add-on purchases

Multi-Currency & Cross-Border Support

Flutterwave supports various African currencies along with global options like USD, GBP, and EUR. This enables your business to accept payments from customers across regions, fostering scalability and customer convenience.

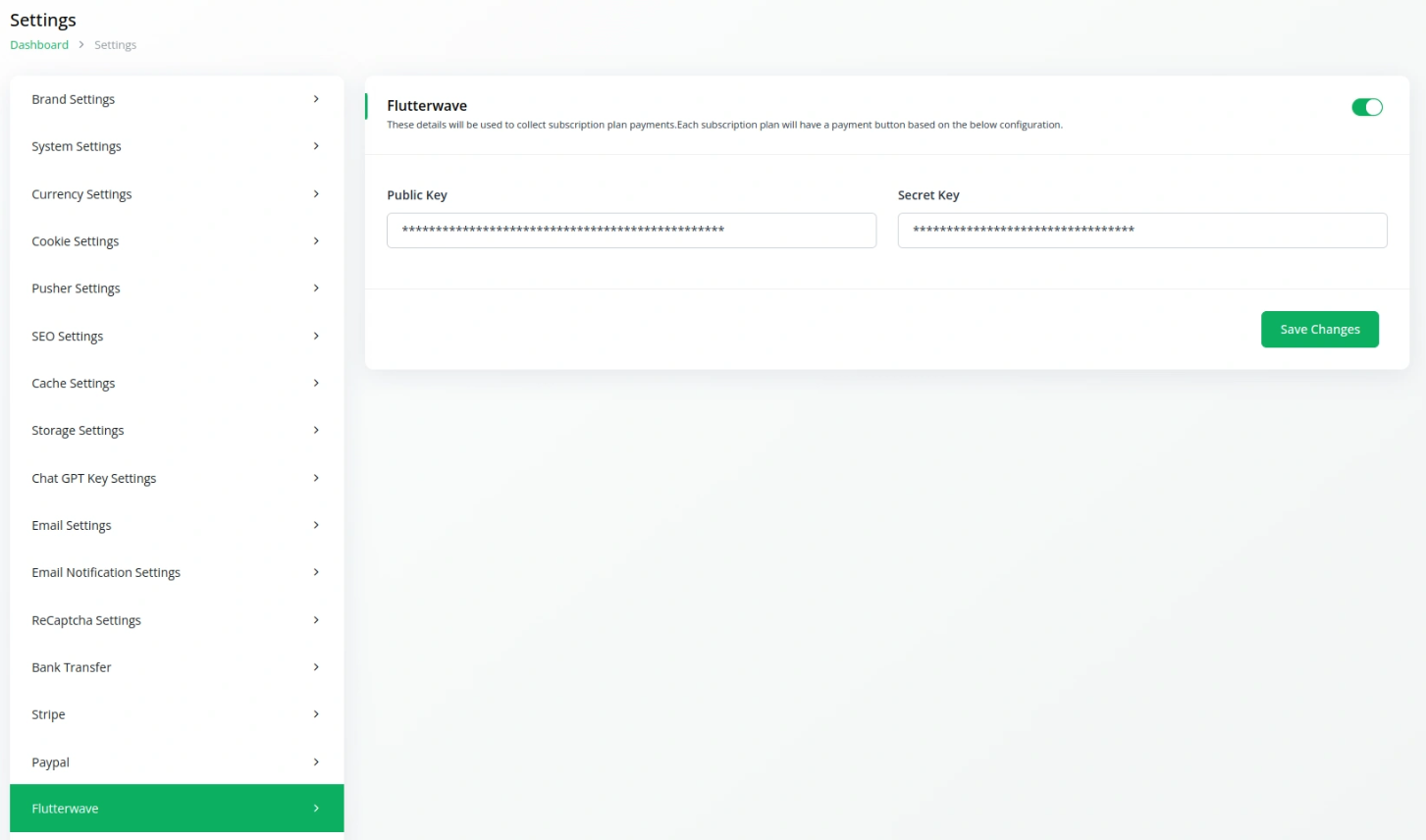

Easy API Key Integration

With the dedicated API Key Settings Page, setting up Flutterwave is straightforward. Whether you’re handling subscription plans or single transactions, integration is consistent, secure, and easy to manage.

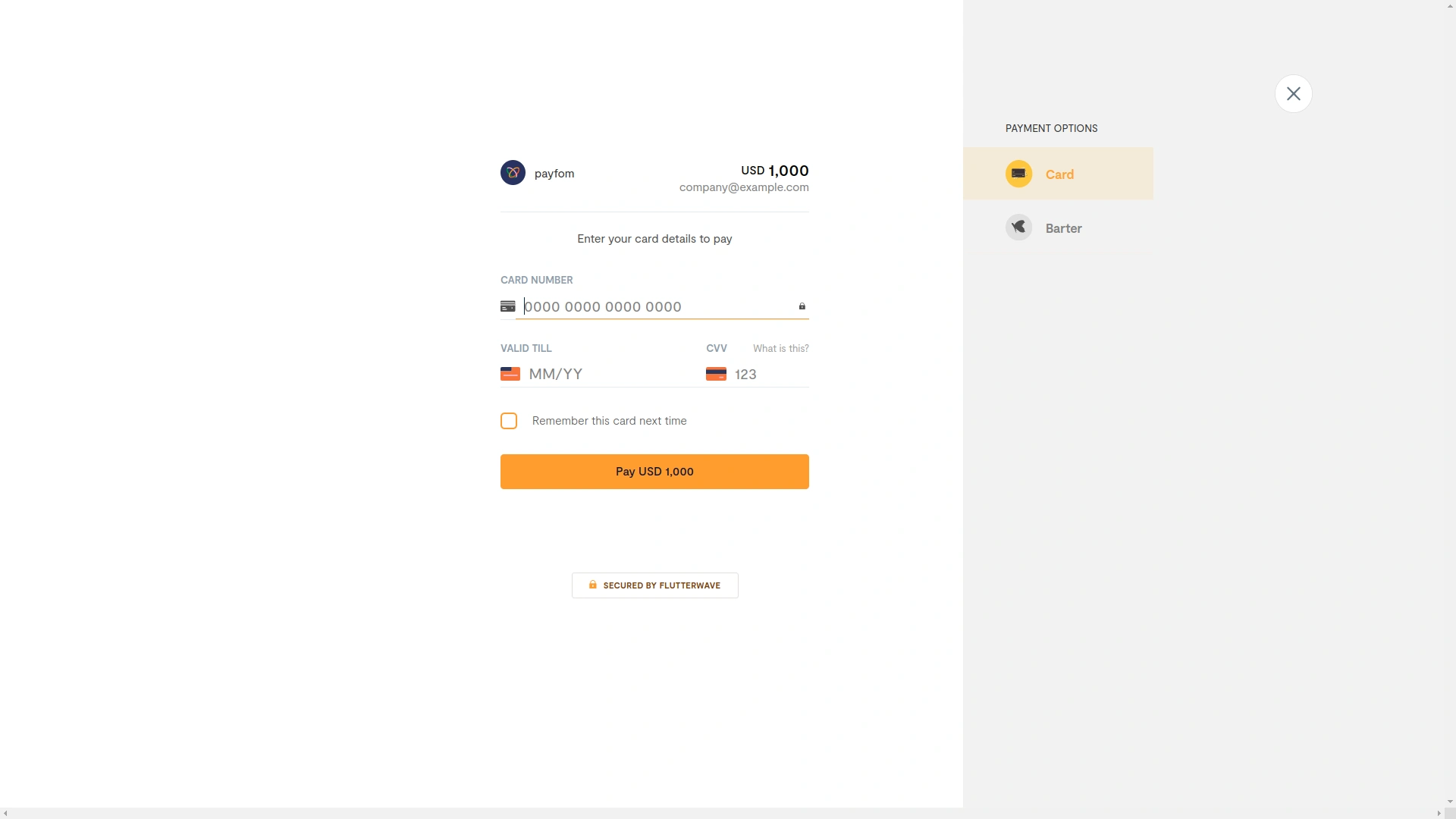

Seamless Invoices and Plan Payments

Create and manage electronic invoices for retainers or completed transactions, and enable recurring payments for subscription plans. Customers enjoy a secure and simplified payment experience, while you benefit from automation and reliability.

Full Description

Borderless Business with Flutterwave

Flutterwave makes it easy to accept payments across African countries and beyond, supporting multiple local currencies and global ones like USD, GBP, and EUR. This allows you to provide customers with a trusted, borderless payment experience that fits their needs.

The integration process is simple with a dedicated API Key Settings Page, letting Superadmins and Companies alike set up their payment flows with ease. Whether you’re managing subscriptions or handling invoice-based payments, Flutterwave keeps transactions secure and efficient.

From enabling electronic invoices to processing recurring plans and purchasing multiple add-ons, Flutterwave delivers a complete solution for businesses that demand flexibility and scale. Build global trust while staying locally relevant with one powerful payment partner.